Are you looking for an honest Spartan Protocol Review? Search no more because, in this article, we will be reviewing Spartan Protocol honestly, we will also explain how it works, its pros and cons, and everything you need to know about the platform.

What is Spartan Protocol | Spartan Protocol Review?

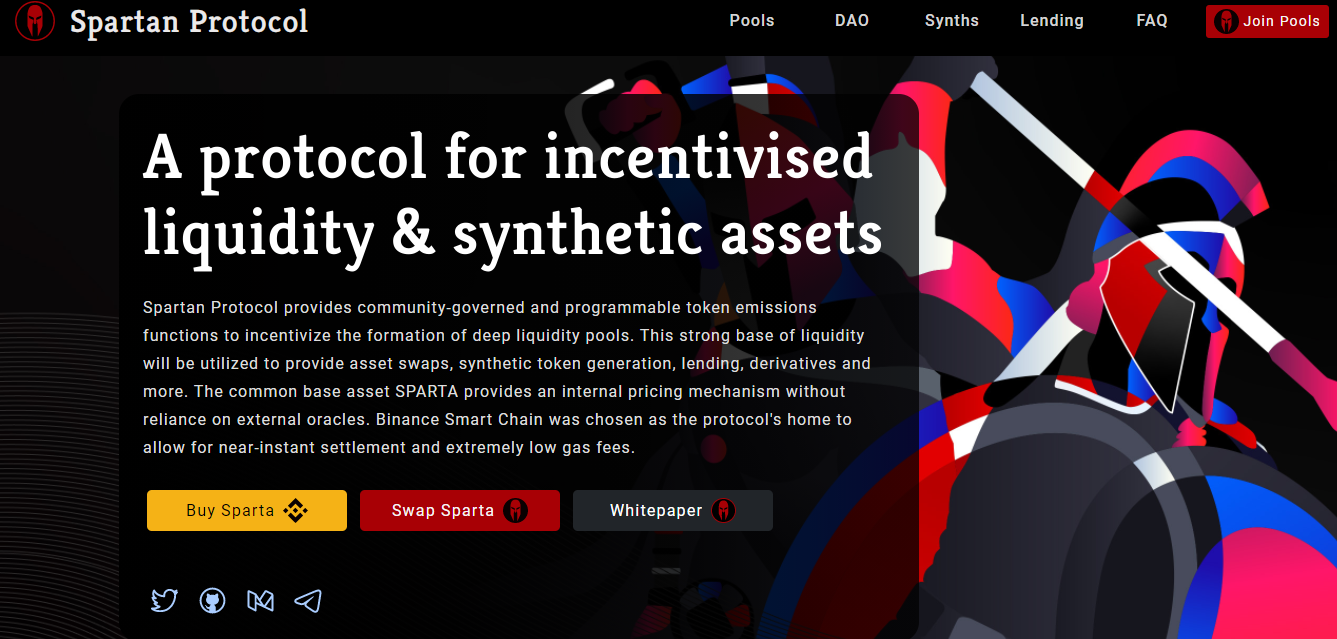

According to the information found on the Spartan Protocol page,

Spartan Protocol provides community-governed and programmable token emissions functions to incentivize the formation of deep liquidity pools. This strong base of liquidity will be utilized to provide asset swaps, synthetic token generation, lending, derivatives, and more. The common base asset SPARTA provides an internal pricing mechanism without reliance on external oracles. Binance Smart Chain was chosen as the protocol’s home to allow for near-instant settlement and extremely low gas fees.

⇒Join us on Telegram for more Sure and Accurate football-winning tips every day...click here

How Spartan Protocol works

You can watch the YouTube video below to understand more about how Spartan Protocol works.

Sparta is the native currency that is used in the Spartan protocol ecosystem.

How to Buy Sparta Token

- Register on Coinbase

- Buy any major coin like Bitcoin, etc with your local currency

- Swap your BTC to Sparta.

How to sell Sparta Token

You can sell your Sparta token by sending it to someone that is in need of it and get paid in your currency (peer to peer ), or you exchange it to other cryptocurrencies like Bitcoin and Ethereum so you can easily withdraw it to your bank.

Spartan Protocol Features

SpartanPools

The heart of the Spartan Protocol is its incentivized liquidity pools, driving on-market capital formation. The liquidity pools are facilitated by an automated-market-maker (AMM) algorithm with liquidity-sensitive fees. Liquidity-sensitive fees ensure the system can sense correct token purchasing power at all times, allowing scalable and risk-tolerant growth

SpartanSynths

The Spartan Protocol allows the generation of synthetic assets, using price anchors offered by its own liquidity pools, collateralized by liquidity pool shares. Liquidity pool shares are on-market, value-stabilized, and can be instantly liquidated. Liquidity-sensitive fees ensure positions taken up will scale with the depth of available liquidity, preventing deleveraging spirals common to other systems.

SpartanLending

Synthetic token minters are short the value of the token, and long the value of their collateral. By winding up their position, they can achieve leverage. The opposite is also true for those wishing to leverage long a token. Lending is possible using a system of fees and collateralized debt. Liquidations of unhealthy positions are done instantly via liquidity pools, ensuring the system is always safe.

Spartan Protocol Contact Information

Just in case you have any need to contact the Spartan Protocol team, you can do that using the social media handle below.

Spartan Protocol Review | Is Spartan Protocol Legit or Safe?

At the time of writing this article, we can say that the Spartan Protocol coin is legit and safe to use.

We have finally come to the end of this Spartan Protocol review, if you like our blog, kindly bookmark it or subscribe to it.