If you come across “IRS code 971” on your tax transcript, chances are that you’d want to know what this means.

To prevent you from getting worried about the code or thinking that you have a problem with the IRS, we’re going give a detailed explanation about IRS code 971.

This post will not only explain what IRS code 971 on a transcript implies but also, it will guide you on how to check your tax transcript for the code.

⇒Join us on Telegram for more Sure and Accurate football-winning tips every day...click here

What Does It Mean When IRS Code 971 Appears on a Tax Transcript?

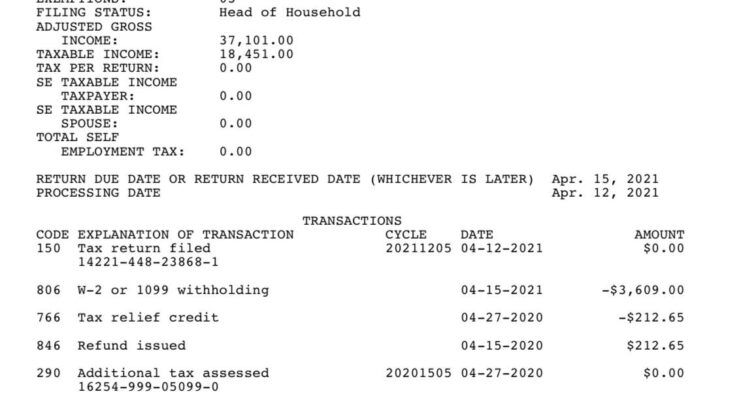

While IRS code 971 is unlikely to spell something negative about your transcript, it’s noteworthy that the code generally indicates that your tax return is currently being reviewed by the IRS.

Most of the time, IRS code 971 appears on your transcript to hint that the IRS is conducting a (normal) 60-day review on your tax return, and that you’ll eventually be paid your unemployment tax return through cheque, mail, or the direct deposit option.

When you see IRS code 971 on your transcript, you should rest assured that your tax return is under a normal review; there’s no need for you to provide additional documentation, and you’ll soon be paid your unemployment tax return.

Now that you know what IRS code 971 implies when it appears on a tax transcript, you may want to check your tax transcript for this code. In that case, you should read this post further in order to find out how to do that. Meanwhile, we can understand “checking your tax transcript for IRS code 971” as wanting to check your tax refund status (i.e., trying to know if you’ll get an unemployment tax return).

Checking Your Tax Transcript for IRS Code 971 –How Is It Done?

Since the IRS runs an official online platform, you’ll likely find it easy to check your tax refund status online. The online route is, in fact, the best way to easily confirm if your tax transcript bears the IRS Code 971.

The procedure to check your tax refund status online is far from difficult, but you need to have an online account with the IRS. We suppose that this is your first time of attempting to verify your tax refund status online and so, we advise that you first create the online account. Notably, it’s this online account that will enable you to manage your tax transcript online.

Creating an online account

You’ll have to visit IRS’ official website and create the account, provided you don’t have one yet. Without this account, there’s no way you can view –or keep tabs on –your tax transcripts online. If you want comprehensive online access to your tax transcript (including being able to download, view and print it), you definitely need to have an account on the IRS website.

While creating the account, you’ll be required to provide such important credentials as full name, date of birth, (valid) email address, current (residential) address, tax filing status, and individual tax identification number (ITN) or social security number (SSN).

Every piece of information you’re providing during account creation is expected to be correct. You must also avoid spelling errors, so that IRS can easily verify your information. Once you have successfully created this online account, you’re free to proceed to checking your tax refund status.

Verifying that you’ve received a tax refund

You need to access your tax transcript before you can confirm if you’ve actually received a tax refund. Provided you now have an online account with the IRS, simply visit the IRS website and navigate to the IRS transcript tool page. Scroll down to and click the Get Transcript Online button.

Then in the non-Social filer’s section, you’ll have to provide your details such as filing status, security number, phone number, email address, etc. After that, click the Continue button.

To verify that you’ve received a tax refund, you have the option of either obtaining the transcript online (and confirm the tax refund status) OR having the transcript delivered to you by mail. Since we suppose that you’d like to obtain your transcript online (and check whether you’ve received a tax refund), here is how you can go about that:

The website of IRS has a “Where’s My Return” feature that lets you check your tax refund status. All you need to do is to provide the necessary details –refund amount, social security number, and filing status –in the required fields. Then scroll to and click the Submit option. Provided you didn’t supply “wrong” details, you should be able to see information about your tax refund status.

By “wrong” details, we mean providing a social security number, filing status, etc., that do not correspond to the ones you provided at the point of account creation.

Finally, if your tax transcript bears IRS code 971, you can then rest assured that you’d have a refund of your unemployment tax. While noting that you too will be paid an unemployment tax refund soon, it’s worth mentioning that your payment will be made via cheque, mail or direct deposit.

Frequently Asked Questions

What’s the Easiest Way to Check My Tax Refund Status?

IRS’ “Where’s My Return” feature is probably the simplest way you can check if you’ve received the IRS unemployment tax refund. If you’ve already created an account on IRS, all you need is to use the “Where’s My Return” feature in providing the necessary details –refund amount, social security number, and filing status. Except you fail to supply correct details, you shouldn’t find it difficult to check your tax refund status using this feature.

Is IRS Code 971 the Same as IRS Notice 971?

No, and we hope you won’t confuse IRS code 971 (which carries a single specific meaning) with IRS Notice 971 (which appears very ambigious). As mentioned earlier, IRS code 971 appears on your tax transcript to generally imply that your unemployment tax return is currently under (normal) review by the IRS, and you’ll be paid the tax return as expected.

It’s normal for the IRS to place your tax return under review for 60 days. So when you see “IRS code 971” on your tax transcript, you may not have to panic or assume that something is wrong with your tax return.

IRS notice 971, on the other hand, usually comes as a notification which might have any of numerous meanings. With that said, it’s now clear that you won’t have to mistake this notification for the IRS code 971 that appears on a tax transcript.

Conclusion

With everything we’ve said about what IRS code 971 on a tax transcript means, you needn’t assume that the code signifies something negative about your tax return status. Most times, the code indicates that your tax return has been placed under a (usually) 60-day review following which you’ll be paid your unemployment tax return by means of mail, cheque or direct deposit.

If you’re pretty sure that you’ve fulfilled all the necessary requirements for your unemployment tax refund, there’s no need for you to panic about your tax refund status. But if you’re still skeptical about the IRS code 971 on your transcript, we advise that you approach an expert on tax matters for consultation.