Unsecured Personal Loans Online – What One Should Know Before Borrowing

In today’s digital age, obtaining a personal loan has become easier than ever. With a plethora of online lenders offering unsecured personal loans, borrowers have greater accessibility and convenience. However, before diving into the world of online borrowing, it’s crucial to understand the key aspects and considerations associated with unsecured personal loans.

In this blog post, we will explore what you should know before borrowing an unsecured personal loan online, ensuring you make informed decisions and maintain financial well-being. We will also consider Unsecured Personal Loans Online, the merits and the demerits exhaustively.

Unsecured personal loans online are loans that are obtained without requiring collateral, such as a car or house. These loans are typically based on factors such as creditworthiness, income, and employment history. Borrowers can apply for and receive funds through online platforms, making the process quick and convenient. While unsecured personal loans offer several advantages, it is important to consider their merits and demerits before deciding to borrow.

⇒Join us on Telegram for more Sure and Accurate football-winning tips every day...click here

Merits of Unsecured Personal Loans Online:

- No Collateral Requirement: Unlike secured loans, unsecured personal loans do not require borrowers to provide collateral. This means you don’t have to risk losing your assets if you default on the loan. This can be especially beneficial for individuals who don’t own valuable assets or are reluctant to use them as collateral.

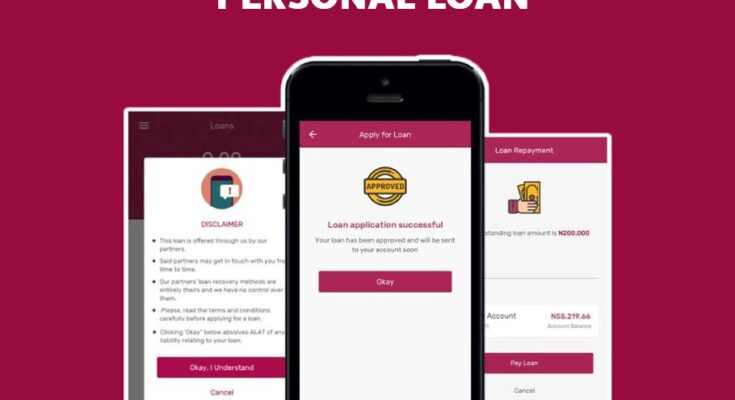

- Quick and Convenient Application Process: Online lenders streamline the loan application process, making it faster and more accessible. Borrowers can complete applications online from the comfort of their homes, often receiving loan decisions within a short period. The funds can be disbursed quickly, providing immediate financial relief for urgent needs.

- Versatile Use of Funds: Unsecured personal loans provide borrowers with flexibility in how they use the funds. Whether it’s consolidating high-interest debt, funding home improvements, covering medical expenses, or planning a vacation, borrowers have the freedom to allocate the funds as per their needs.

- Potential for Lower Interest Rates: While unsecured personal loans generally have higher interest rates compared to secured loans, borrowers with excellent credit scores may qualify for lower rates. Online lenders often consider various factors when determining interest rates, including credit history, income, and employment stability.

Demerits of Unsecured Personal Loans Online:

- Higher Interest Rates: Unsecured personal loans typically come with higher interest rates compared to secured loans. Since lenders assume more risk without collateral, they compensate for it by charging higher interest rates. Borrowers should carefully consider the interest rate and calculate the overall cost of the loan before committing to ensure it fits within their budget.

- Creditworthiness Requirements: Online lenders heavily consider credit scores and credit histories when evaluating loan applications. Borrowers with poor credit may find it challenging to qualify for unsecured personal loans or may be subjected to higher interest rates. It is important to review your credit profile and improve your creditworthiness before applying for a loan.

- Potential for Limited Loan Amounts: Unsecured personal loans may have lower maximum loan limits compared to secured loans. Lenders take into account the borrower’s income, debt-to-income ratio, and creditworthiness when determining the loan amount. If you require a significant sum of money, an unsecured personal loan may not be sufficient to meet your needs.

- Possible Origination Fees and Penalties: Some online lenders may charge origination fees, which are upfront fees deducted from the loan amount. Additionally, borrowers should be aware of potential penalties for late payments or early repayment. It is crucial to review the loan agreement and understand the fees and penalties associated with the loan before proceeding.

Unsecured personal loans online provide borrowers with convenient access to funds without the need for collateral. They offer flexibility and a quick application process, making them attractive options for individuals in need of financial assistance. However, borrowers should carefully consider the merits and demerits of these loans, including higher interest rates, creditworthiness requirements, and potential fees and penalties. By evaluating their financial situation, exploring multiple lenders, and understanding the loan terms, borrowers can make informed decisions and ensure that an unsecured personal loan aligns with their financial goals and capabilities.

- Understanding Unsecured Personal Loans: Unsecured personal loans are loans that don’t require collateral, such as a house or car. These loans are typically based on your creditworthiness, income, and other factors determined by the lender. Unlike secured loans, unsecured personal loans carry higher interest rates since the lender assumes a greater risk.

- Assess Your Financial Situation: Before considering an unsecured personal loan, conduct a comprehensive assessment of your financial situation. Determine the amount you need to borrow, the purpose of the loan, and your ability to repay it within the specified terms. Analyze your income, expenses, and existing debt obligations to ensure you can comfortably manage the loan repayment alongside your other financial responsibilities.

- Check Your Credit Score: Your credit score plays a pivotal role in securing favorable loan terms and interest rates. Online lenders heavily rely on credit scores to evaluate borrowers’ creditworthiness. Before applying for an unsecured personal loan, check your credit score and review your credit report for any errors or discrepancies. Taking steps to improve your credit score, such as paying off existing debts, can increase your chances of obtaining a loan at a more favorable rate.

- Research and Compare Lenders: The online lending marketplace is vast and diverse, so take the time to research and compare different lenders. Consider factors such as interest rates, loan terms, fees, and customer reviews. Look for reputable lenders with transparent terms and conditions, ensuring they are licensed and regulated by relevant authorities. Comparing lenders allows you to find the most suitable option that aligns with your needs and offers the best overall value.

- Read and Understand the Loan Agreement: Before finalizing any loan agreement, thoroughly read and understand the terms and conditions. Pay close attention to interest rates, repayment schedules, fees, and any potential penalties for late payments or early repayment. If anything seems unclear, don’t hesitate to reach out to the lender for clarification. Being well-informed about the loan agreement will help you avoid unexpected surprises and ensure a smooth borrowing experience.

- Borrow Responsibly and Avoid Overborrowing: While unsecured personal loans can provide financial assistance during challenging times, it’s essential to borrow responsibly. Only borrow what you need and can afford to repay. Resist the temptation to overborrow, as it may lead to financial strain and jeopardize your creditworthiness. Create a budget and repayment plan to ensure you stay on track with your loan obligations.

Conclusion:

Unsecured personal loans offer a convenient way to access funds quickly, especially through online lending platforms. However, it’s crucial to approach these loans with caution and make informed decisions. By understanding the nature of unsecured personal loans, assessing your financial situation, researching lenders, checking your credit score, reviewing loan agreements diligently, and borrowing responsibly, you can navigate the online borrowing landscape effectively. Remember, a well-informed borrower is better equipped to manage their finances and make the most of their borrowing experience.