Buying stocks is a good way of investing, however, most times buying stocks can be very expensive this is why it is advisable that you start up with these 5 Best Apps to Buy Stocks for Free so you can really understand how the stock market0 works if you are a novice and also raise some money before going into the real deal.

5 Best Apps to Buy Stocks for Free

Below are the 5 Best Apps to Buy Stocks for Free

1. M1 Finance

- Minimum Investment: $100

- Commission: $0

- Monthly Fee: $0

- Account Type: Taxable, IRA

- Best for: Beginners

M1 Finance is ideal for newcomers to the world of investing as well as for passive investors. The platform combines the greatest features of low-cost brokerages with behavioral alpha to help investors gain confidence in their investments.

⇒Join us on Telegram for more Sure and Accurate football-winning tips every day...click here

Sound investing options, such as low-cost exchange-traded funds (ETFs) and individual shares, are also made possible by the platform. M1 Finance also features a number of tools to assist you in creating your perfect portfolio, including the ability to automate contributions.

For its regular accounts, M1 Finance also uses Assets Under Management (AUM), a free Robo adviser service. M1 Fiance can compete with some of the cheapest companies in the field, such as SoFi Invest and Charles Schwab’s Intelligent Portfolios, because to its free access feature.

In addition, the app provides free consulting services and enables clients to build fractional share portfolios. M1 Finance, in addition to automating investments, also offers automated rebalancing to guarantee that you are buying cheap and selling high.

Premium customers may also take advantage of Smart Transfers, which make it simpler to move money between their Spend and Invest accounts. M1 Borrow, a new feature on the site, recently gave customers access to a line of credit.

Pros

- Plenty of bonus offers

- Constantly adds more features and support

- Allows custodial accounts

Cons

- Not designed for active traders

2. Webull

- Minimum Investment: $0

- Commission: $0

- Monthly Fee: $2 per month (Level 2 Subscription)

- Account Type: Taxable, Rollover IRA, Traditional, and Roth

- Best for: Experienced Traders

Pros

- Free stocks, options, and ETFs

- Low trading fees

- Opening an account takes about a day

Cons

- It doesn’t support bonds, mutual funds, and pink sheet stocks

3. Robinhood

- Minimum Investment: $0

- Commission: $0 for stocks, crypto, ETFSs options

- Monthly Fee: $0

- Account Type: Taxable

- Best for: New Investors

During the recent GameStop short squeeze, Robinhood’s appeal as a commission-free stock trading platform grew even more. Despite the criticism, the app is still a good option for first-time investors.

Its application is simple to use and understand. On Robinhood’s platform, you may trade and invest in hundreds of individual stocks and ETFs. There is no need for a minimum deposit to start an account.

Furthermore, the platform supports advanced order types such as market order, limit order, stop-loss order, and stop-limit order as part of automating your trades. You may buy or sell your stocks at the prices you wish by placing orders in advance.

You may also trade cryptocurrencies without leaving the app thanks to its connection with Robinhood Crypto. This site allows you to purchase, trade, and exchange prominent cryptocurrencies including Bitcoin, Ethereum, and Litecoin.

However, since the federal interest rate changes over time, Robinhood’s rate may vary as well. Unlike its rivals, Robinhood is less restrictive in terms of who may use the platform, allowing non-U.S. citizens to use the app as long as they have a visa to enter the country.

Pros

- Allows dividend reinvestment and fractional shares

- Facilitates commission-free trades

- Utilizes security features such as Apple Touch for logging in

Cons

- The platform has become a bit unreliable since the GameStop issue

4. Fidelity

- Minimum Investment: $100

- Commission: $0 for stocks, ETFs, options

- Monthly Fee: $0

- Account Type: Taxable, Trust, IRA, 401K, HSA

- Best for: New Investors

One of the biggest client bases belongs to this industry-leading online broker. The website and app from Fidelity both provide features to assist regular investors to keep track of and managing their holdings.

Fidelity is also one of the few firms that does not take Payment for Order of Flow (PFOF), saving you money on stock transactions.

Fidelity is well-known for its outstanding research. Their stock, mutual fund, and ETF screeners are straightforward to use and include a lot of information. For both ETFs and equities, the firm relies on the most third-party research reports.

Fidelity also doesn’t have any hidden fees or account service fees, which is a huge plus. If you choose broker-assisted transactions, you will be charged a fixed cost of $19.95. Fidelity also offers zero-expense-ratio mutual funds, which may help you save even more money.

The Fidelity app has a beautiful and customizable interface. Its market cards offer anything from market headlines to watch list information. Furthermore, the program has a note-taking feature that enables you to keep your ideas on certain stocks.

Fidelity’s active trader feature, on the other hand, is one of its major flaws. It features a limited number of indicators, with as low as two on Android devices. In contrast, the average for the industry is more than 30 indicators. As a result, it is unsuitable for aggressive traders.

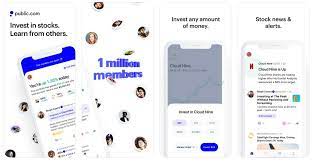

5. Public

- Minimum Investment: $5

- Commission: $0

- Monthly Fee: $0

- Account Type: Taxable

- Best for: Small-time Investors

Public is a commission-free stock trading and investment platform. The app has no monthly account maintenance or membership costs, and there are no minimum account balance requirements.

Public isn’t precisely a new player in the sector, contrary to most people’s initial impressions. It’s a redesign of Matador, one of the country’s first app-based investment platforms.

You may now download a nicely designed and user-friendly smartphone app for Android and iOS. You may start trading on the app with only $5. If you go public, you may invest in and trade thousands of individual stocks via ETFs.

Through the app, you may also invest in and trade fractional shares of stocks, known as slices. You may acquire a portion of the shares rather than the complete stock. Public also has a distinct social layer with a social community where you may talk with your friends. You may also contact experts in the subject of investment, such as industry leaders and professionals.

Another unique feature of Public is the possibility of earning a significant amount of interest on your cash balance. Uninvested cash in your cash account that isn’t in your Public portfolio might earn you a small percentage. However, they don’t allow day trading and, for the time being, only U.S. citizens are allowed to join the platform.

Pros

- The app has social investing features

- Allows fractional shares for as little as $1

- Low barrier of entry

Cons

- Limited investment options compared to its competition