The world of financial technology, or fintech, is evolving at a rate that has never been witnessed before, with developers at the forefront of this revolution. Fintech applications, which address payment processing, money management, and other issues, are becoming essential for businesses of all sizes. In this piece, we’ll look at the top 10 fintech apps to assist developers in empowering their businesses and keeping a competitive edge in the highly competitive financial sector.

Fintech Applications Can Help Developers See New Innovation Opportunities

Financial technology, sometimes known as fintech, has drastically changed the way we manage, invest, and spend our money. In the digital age, developers may create creative solutions thanks to modern fintech apps, which serve as the cornerstone of financial innovation.

Let’s look at the importance of fintech apps for developers and how they promote innovation in the banking sector.

⇒Join us on Telegram for more Sure and Accurate football-winning tips every day...click here

1. Digital Transition Accelerated by Fintech

The financial institutions and enterprises are undergoing rapid digital transformation. Developers can include fintech apps’ numerous capabilities and APIs into their applications to facilitate digital payment processing, investment solutions, and financial management. This accelerates the process of moving traditional banking processes into the digital era.

2. Accurate and simple payment processing

Fintech apps give developers the flexibility to create efficient and safe payment processing solutions. Regardless of whether you are creating a mobile wallet, e-commerce platform, or subscription service, fintech companies like Stripe and PayPal provide APIs that streamline the payment process. This convenience improves user satisfaction and makes customers happy overall.

3. The Finance Department’s Role

Fintech applications go a long way toward promoting financial inclusivity. People who lack access to traditional banking infrastructure can use these apps to transfer money, invest, and access financial services. The poor can get services and reduce the wealth gap with the aid of apps developed by developers.

4. Investment Prospects

Fintech app developers may create investing platforms that appeal to a wide range of investors thanks to the possibilities these apps bring. Whatever your interest in real estate crowdfunding, robo-advisors, or peer-to-peer lending, fintech apps like Addepar and Wise (formerly TransferWise) offer APIs that let developers create innovative investing platforms.

5. Improved Management of Cash Flow

The administration of personal and commercial finances is made easier by fintech applications. The development of apps like Xero and Intuit QuickBooks that offer financial management and accounting APIs is possible. One approach to accomplish this is to create apps that let users track their spending, get financial reports, and get better financial situations.

6. Data-Produced Information

Fintech apps have a wealth of financial data available. Developers may utilize this data to create apps that provide users with data-driven insights into their investing, spending, and financial habits. Machine learning and artificial intelligence have the potential to offer personalized financial recommendations and predictions.

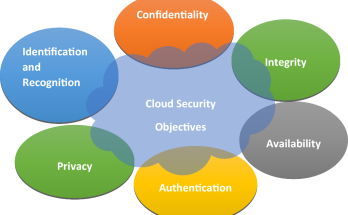

7. Extra Defense

Because security is so vital to them, many fintech apps offer robust security measures. This area includes developing apps for developers that safeguard user data and allow safe, encrypted purchasing. It is necessary to have the opportunity to research and apply state-of-the-art security techniques in order to win people’s confidence.

8. International Cooperation

Fintech applications are everywhere. By providing multi-currency accounts, international money transfers, and cross-border payments, developers enable businesses and individuals to carry out cross-border transactions more effortlessly. The worldwide banking industry can significantly expand the user base of your applications.

Top 10 Fintech Apps for Developers to Explore

With fintech apps emerging as a primary engine behind financial innovation, development teams are driving this innovative route. These apps can be used by developers to build solutions that aid in digital transformation, enhance financial management, and provide financial services to the needy.

Financial apps are crucial to developers, and this cannot be overstated. By looking into and using these apps, developers may be able to inspire change in the financial sector and usher in a new era of innovation and financial empowerment. Whether your concept is to process payments, invest, or achieve financial inclusion, fintech applications give you the tools and APIs you need to make it happen.

1. Stripe

Stripe is a global payment processing platform that offers an extensive range of tools and APIs for online businesses. Developers may integrate Stripe into their programs to handle complex financial transactions, manage subscriptions, and accept online payments. Because of its thorough documentation and developer-friendly approach, Stripe is valued by both businesses and developers.

2. Plaid

Financial technology company Plaid makes it feasible for applications to be connected to customers’ bank accounts. With Plaid’s APIs, developers may access financial information, confirm account details, and carry out ACH transfers. It’s quite helpful for financial apps, budgeting tools, and payment networks.

3. Square

Apart from its popular point-of-sale systems, Square also offers a range of developer tools, such as SDKs and APIs. These technologies allow businesses to create custom applications suited to certain economic sectors, manage inventories, and accept payments both offline and online.

4. Adyen

The payment processing platform Adyen provides coverage throughout the world. It allows APIs to accept payments in multiple currencies and supports payment methods. With Adyen, developers can effortlessly create solutions for cross-border payments.

5. Intuit QuickBooks API

Companies frequently use the popular accounting software Intuit QuickBooks. Developers can streamline the management of users’ accounts, bills, and expenditures by integrating their apps with QuickBooks, which is made possible by the QuickBooks API.

6. PayPal

Thanks to its accessible APIs, PayPal is a well-known online payment platform that makes it simple for developers to create original payment solutions and take payments. PayPal enables programmers to design secure online payment systems.

7. TransferWise (Wise)

TransferWise, now known as Wise, is a user-friendly international money transfer service provider. By integrating international financial services into their apps using Wise’s API, developers can make cross-border transactions easier for users.

8. Xero

Cloud-hosted accounting software for small businesses, Xero, is well-liked. By using the Xero API to connect their apps to Xero, users can easily manage their bills, payroll, and money.

9. Addepar

The wealth management platform Addepar offers an API for collecting and analyzing financial data. Addepar offers developers APIs to build financial planning and portfolio management systems.

10. Yodlee

Yodlee, a data aggregation platform, offers APIs for financial data and account connectivity. Developers may create apps that offer in-depth financial metrics and insights by utilizing Yodlee’s capabilities.

Conclusion

The world of fintech is continuously evolving, and developers play a critical role in shaping the financial landscape. These top 10 fintech apps and platforms offer a wide array of APIs and tools to empower businesses and create innovative financial solutions. Whether you’re working on payment processing, financial management, or wealth analysis, these fintech apps provide the building blocks for your applications. Stay ahead of the curve by exploring these fintech solutions and driving innovation in the financial technology sector.